Setting Up Payments on Your Website: Our Top Ways To Take Payments Online

If you click to purchase a product or service based on our independent recommendations and impartial reviews, we may receive a commission. Learn more

Maybe you’ve just decided you want to build an online store, or you might be looking to integrate payments to a site you already have. Whatever brought you here, one thing’s for certain – you want to know how to accept payments online.

But with so many payment options to choose from and so many factors to consider – like cost, convenience, and the speed of payment – it can feel overwhelming to know which electronic fund transfer (EFT) methods you should equip your store with. And it’s a decision worth the deliberation; according to PPRO, an eye-opening 42% of shoppers say they would abandon their cart if their preferred payment method wasn’t available.

But don’t worry! This article will walk you through each method of taking payments online to help you understand which are the most relevant for your situation. We’ll cover ways to take online payments for ecommerce, as well as some alternative ways to get paid online. Let’s get into it!

Before You Start Accepting Online Payments

Before you start accepting electronic payments online, you’ll need a merchant account.

Also known as credit card processing, a merchant account is a type of bank account that enables you to accept online payments.

Once a customer has tried to purchase something from your website, the merchant account holds the funds temporarily while certain monetary checks are made. The process usually goes like this:

- Customer makes a purchase

- Merchant account checks whether funds are available

- Transaction verified by card association (Visa, Mastercard, etc.)

- Money enters your business bank account

Usually, the money is held within the merchant account for a couple of working days while the payment is verified, authorized, and deemed secure.

As we said, a merchant account is a type of bank account, so you would connect your merchant account to your website as you would with any other type of bank account.

When you’ve set up your merchant account, you’re ready to accept payments online. Let’s get into four common methods!

1. Payment Gateway

Best for businesses needing a tailored solution with lots of support.

An effective way to accept payments online is through a combination of a merchant account and a payment gateway.

Simply put, a payment gateway connects your website to a checkout system. It links your website to the likes of Visa, Mastercard, and American Express, either embedding a checkout page on your website or redirecting your customers to the payment gateway’s own website to complete the purchase.

Here are a few of our favorite payment gateway recommendations that are easy to set up and charge zero setup fees or hidden payments:

Stripe

Best for subscription-based businesses.

Stripe is one of the most customizable payment gateways out there, enabling you to fully customize and embed a sleek checkout onto your website. Most alternatives either require you to use their own checkout template, or force your customers to leave your site and use the payment gateway’s website in order to checkout.

Stripe’s top feature is Stripe Billing, which lets you set up recurring bills or one-off invoices quickly and easily.

Stripe fees:

- Monthly fee: $0

- Setup fee: $0

- Online transaction fee: 2.9% plus 30 cents per transaction

- Stripe Billing costs: 0.5-0.8%, depending on plan

PayPal

Best for adding a checkout for free.

As a household name, PayPal’s checkouts fill your customers with confidence, letting them know their money is in safe hands. While PayPal’s checkouts are quite basic, they can be easily added to your payment process at no cost. PayPal’s top feature is its One-Touch checkout, which creates a sleek experience for your customers.

PayPal’s fees differ based on the type of transactions you’re accepting, and the countries they’re coming from. For the full rundown, check out PayPal’s merchant fees.

While we’ve mentioned two strong options for payment gateways, there are hundreds out there, with lots of different transaction fees and credit card processing features to consider.

Fees:

Using the combination of a merchant account and a payment gateway to accept online payments means you’ll be paying a fee for both. Payment gateway fees vary, but for each transaction, you’ll usually be charged a flat fee (around $0.30) plus a percentage of that transaction (1.4% to 3.5%).

Pros:

- When set up correctly, payment gateways offer lots of control over security.

- They are relatively easy to set up and to use.

- When you do run into problems, payment gateways have strong customer service options, especially if you’re dealing with the most well known.

- They accept all major credit cards like American Express, Visa, and Mastercard.

Cons:

- Using a payment gateway may be an expensive way to accept online payments as you’ll be paying multiple fees.

2. All-in-One Ecommerce Platform

Best for new businesses that want everything in one place.

If you either haven’t set up your website yet, or you’ve built a website with an ecommerce builder such as Shopify or Wix Ecommerce, we’d recommend taking advantage of their “all-in-one” solutions, which combine easy-to-use website builder tools with the world’s leading payment gateway integrations.

Shopify and Wix offer their own payment gateways, Shopify Payments and Wix Payments, which both come with zero transaction fees for customers using their respective builders! However, they both can also integrate different payment gateways including PayPal, Square, and Stripe – so you can keep your options open.

Fees:

You’ll be paying a monthly subscription fee to use the website builder’s ecommerce features, as well as transaction fees, if the gateway you use charges them.

Pros:

- Most of these all-in-one solutions have their native payment gateways already set up with everything you need when you open an account, so you won’t have to apply for a merchant account or third party payment providers.

- Using these can save you money with zero transaction fees.

- Having everything on one dashboard is convenient and makes your sales easy to track.

Cons:

- You’ll have to pay extra transaction fees for using third party gateways.

- To take advantage of the all-in-one solutions you’ll also need to be paying for the builders’ monthly plans, which can become expensive.

3. Digital Wallet Payments

Best for businesses looking to grow their international customer base.

Also known as mobile wallets, these apps store your customers’ bank card details on their smartphones. The big perk of digital wallets is that they enable users to make quick payments online (if the online store accepts mobile app payments, that is.)

Data predicts that by 2026, over 60% of the population will use this payment method, so adapting your store to accept online payments from digital wallets will positively impact a lot of your existing and new customers.

Some examples of digital payment wallets that you’ll likely recognise are Apple Pay, Google Pay, and Samsung Pay. These allow users with either Apple, Google, or Samsung devices like phones, watches, tablets, and laptops to use fast online and in-store checkouts. All users have to do is register their card details in their Apple Wallet, and from there they can pay online using either their face or fingerprint ID to verify.

There are also popular alternatives in China, like WeChat Pay and AliPay. If you’re looking to branch out to the Chinese market, offering these will be advantageous.

So, how can you accept digital wallet payments? Well, one route is to use Application Programming Interface (API). With this method, you’d use code to interact with the digital wallet providers API, which will give you a lot of freedom and customization. Unfortunately, it requires considerable development knowledge, so if you’re a tech beginner, you may find using an ecommerce platform easier.

The majority of ecommerce platforms – including Squarespace Ecommerce and BigCommerce – will provide your website with the ability to accept digital wallet payments within their most basic price plans.

Fees:

Fees vary with different payment processors and digital wallet companies.

Pros:

- Digital wallet payment is very secure due to various inbuilt features like tokenization, encryption, and passwords.

- Digital wallet is compatible with a range of devices, so will increase your opportunities for ecommerce sales.

Cons:

- Because each digital wallet is isolated to devices from that one brand, and the top three brands are equally popular, you’ll have to accept online payments from multiple digital wallet brands to see the full benefits.

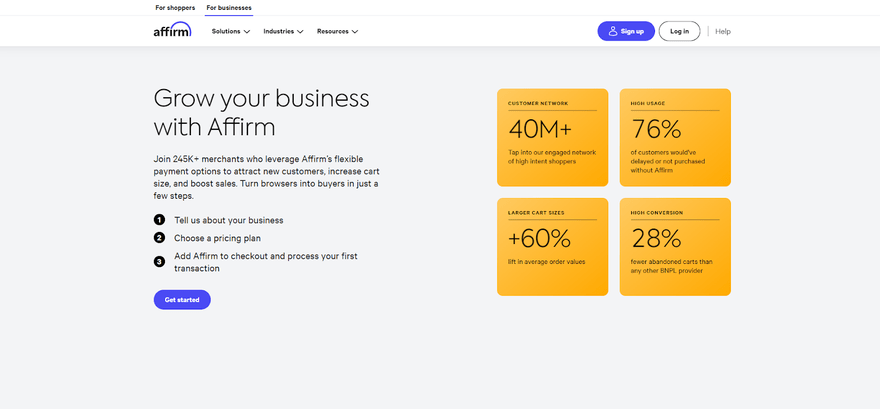

4. Buy Now, Pay Later

Best for businesses selling luxury and high value stock, to help encourage customers to pay the high price point. It’s also effective for businesses selling lower value items and wanting to encourage customer cart growth.

As the name suggests, the ever growing buy now, pay later (BNPL) method is a form of short-term, instant financing, which means your customer can receive their item before paying all of their bill. Buyers are usually offered the option of a deferred bulk payment, usually 30 days later, or to pay in installments over a few weeks or months.

As the merchant, you’ll receive the payment from the BNPL provider instantly, and it’s then down to them to collect the customer’s payments and chase up any delays.

Fees:

Fees vary depending on the provider, and can range anywhere between 1.5% to 7% of each payment.

This range is obviously very large, so check out our guide to buy now, pay later to delve into the fees, pros, and cons of each provider in more detail.

Pros:

- BNPL can be extremely easy to integrate into your store.

- This method improves the user experience of your site by offering customers alternative payment options that are tailored to their individual needs.

- You’ll attract new customers that may not have felt it possible to shop with you in the past due to your product prices.

- The average order value raises considerably for buyers using BNPL, by 18%, according to Adobe. Consumers are more inclined to pay higher value when the payments are spread out into manageable amounts.

- Because of this, cart abandonment has been seen to lower. BNPL reduces the likelihood that customers will hold off their purchase until their pay day and forget about their cart.

Cons:

- The fees are considerably higher than when using a payment gateway, so you should calculate whether the increase in customers and cart value will outweigh this.

- This payment method doesn’t usually cover recurring bills or subscriptions, so it won’t be viable for business in this realm.

- While the provider will take care of any issues with customer payments, there’s potential for bad press and the lowering of your company reputation if customers get in financial trouble over a payment on your platform.

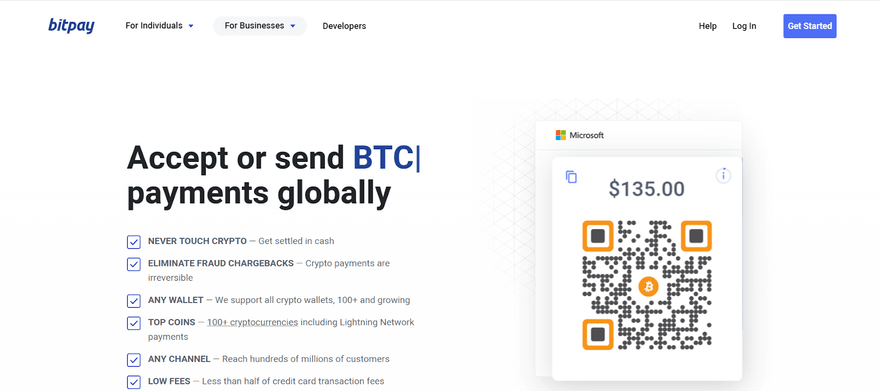

5. Cryptocurrency

Best for businesses that sell in technology or financial sectors.

The 2020s have seen cryptocurrencies – like Bitcoin, Ethereum, and Litecoin – move from the realm of the unknown (and the vaguely dangerous) to the status of a more widely used and accepted payment method. Some countries, such as El Salvador and the Central African Republic, have even begun to accept it as a form of legal tender!

To accept online payments via cryptocurrency, you’ll need to set up a payment processor, a digital wallet, and a payment gateway that all support cryptocurrency. These will differ from the likes of Stripe and Shopify, so if you’re not familiar with the providers, do your research and consider areas such as fees, processing times, user experience, and customer support.

.

Fees:

Crypto payment gateways will charge a transaction processing fee of up to 1%.

Pros:

- Crypto payments allow your business to reach customers all over the world without having to work within the constraints of traditional banking systems.

- Because of this, you’ll pay lower fees than with traditional methods, especially when it comes to international customers.

- Crypto payments have advanced cryptographic security features, which defend you against fraud and chargebacks.

Cons:

- Cryptocurrencies are known for their price volatility – which poses a challenge if your business requires stable pricing.

- If you’re only just learning how to set up payments on a website, adding crypto payment to your ecommerce store will take time and patience.

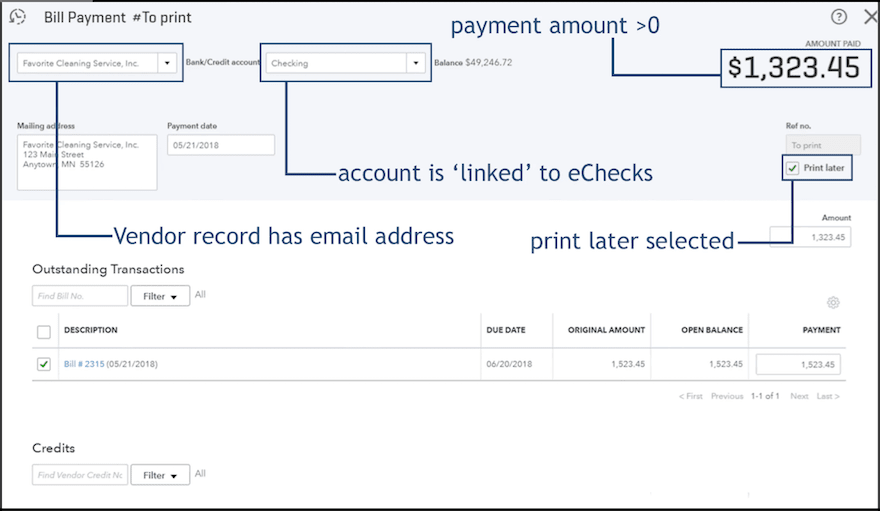

6. eChecks

Best for US-only businesses that take recurring and/or large payments, due to this method’s low fees and automated transactions.

If you’re wondering how to accept payments online without dealing with cards or cash, eChecks may be the solution you’re looking for. A type of EFT (electronic funds transfer), eChecks works just like a paper check, but online!

Much like their paper counterparts, eChecks will deposit money from the customer’s bank account to your business’ bank account via an ACH (Automated Clearing House) software. All the customer needs to do is add some banking details into the online payment form, which is then processed by the ACH after you authorize it.

Fees:

You’ll be charged a flat rate of anywhere between $0.10 and $1.50 depending on your provider.

Pros:

- The low flat rate fees of eChecks make it a cost effective payment solution, especially in comparison to credit cards, whose processing fees can be as high as 4.5%.

- Measures such as transaction validation through micro deposits and data encryption make this a highly secure payment method.

- It’s also a very reliable payment method that’s governed by multiple bodies with strict compliance guidelines.

Cons:

- While the payments are faster than traditional checks, the ACH process means that you’ll be waiting around three to five days for the money to arrive in your account.

- This type of EFT is only accepted in the US, so it limits how widespread your sales can be. If you’re looking to sell internationally,you shouldn’t rely on eChecks as your sole payment method.

All in all, eChecks are a faster, more secure payment method than paper checks, but because they aren’t as widely accepted, they might stunt your financial gain. That said, they’re definitely worth considering if you take high value and recurring payments, as the rates will save you a lot of money in the long run!

How To Choose an Online Payment Method

Now you know the different ways to accept online payments, but this information won’t be of much use unless you know how to apply it to your store. It’s not a case of adding as many as you can afford, but rather finding a unique mixture that will be relevant to your buyers.

Here are some areas to consider when adding payment methods to your store:

- Your target audience: What online payment method would they be most likely to appreciate? For example, If your audience is younger, digital payment wallets will be appreciated, whereas eChecks could be appreciated if you’re selling to elderly people who prefer traditional payment methods.

- Setup: If you need your payments to be set up instantly, a quick solution like an all-in-one builder would be better than cryptocurrency, for which you need to register for multiple accounts.

- Fees: you’ll need to think about the type of payment you take and whether you would benefit from flat rates or variable fees.

- Customer service: if you run into any bumps, especially if you’re only just starting to accept payments, you need to choose payment methods provided by companies that can help you.

Summary

Remember, in order to accept credit and debit card payments, you’ll need to set up a merchant account via your chosen bank – but that’s really easy to do. Once you’ve done that, you can start to accept payments online in multiple ways! The options are endless.

To recap, using a merchant account and payment gateway combination, digital wallets, cryptocurrency, and buy now, pay later are all great ways to diversify your checkout for a global market. And for a method that doesn’t require card details, you could consider accepting eChecks (provided you sell in the US).

When thinking about which payment types to choose, always base your decision on both yours and your customers’ needs, and think about what will be the most convenient for them and the most beneficial for you.

Having read this article, it should now no longer be a question of how to accept payments online, but when!

14 comments