Shopify Has Improved the Ability To Calculate Duties and Import Taxes

If you click to purchase a product or service based on our independent recommendations and impartial reviews, we may receive a commission. Learn more

- Shopify will calculate your taxes in draft orders for you

- Charges for duties and import taxes are calculated through estimates based on the information the customer inputs at the time of the order

If you’re sweating over your taxes on Tax Day, then Shopify has some good news for you. You will now be able to calculate your duties and import taxes in Shopify draft orders. Meaning international taxes are applied to the shipping of the order, so when a draft order is created and the customer checks out it calculates them for you. If you’re curious about building an online store with Shopify then read our Shopify Review for more information.

Don’t worry, we’ll explain everything for those just starting out with taxes.

What Are Import Duties and Taxes?

Taxes are a fee charged on every product sale by the government (or state you are in), while duties are fees you pay for goods leaving or entering the country you sell from. What your taxes and duties amount to depends on where you are and the goods that you’re selling — import taxes can range from 0 to 37.5% of your sale, with the average being 5.63% in the US. But it’s best to check with your state’s local sales tax rate.

More Information

- Ecommerce Shipping Best Practices – Learn more about shipping for your online store.

An Overview of Shopify’s New Draft Orders Calculations

Orders that are placed from regions where you have a fulfillment location are not affected, but rather international or different region orders. As a customer goes to checkout and enters their location, Shopify’s nifty tool will calculate it and tally it to the order.

How To Set Up Duties and Tax Calculations in Draft Orders:

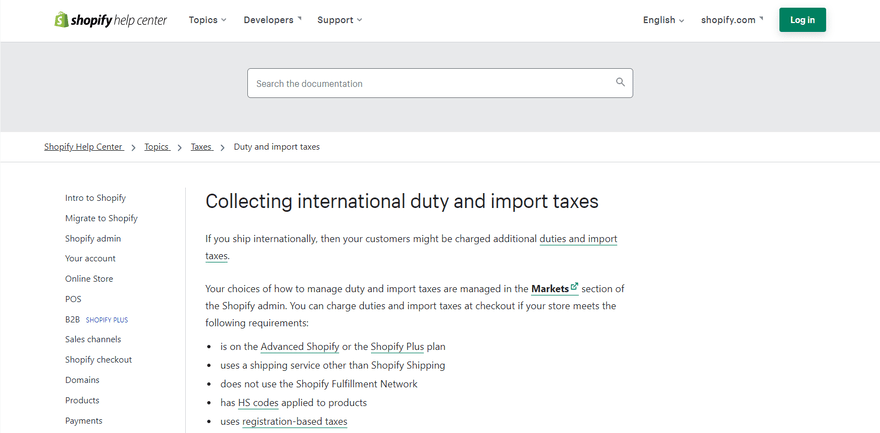

- From the Shopify admin, go to Settings to the Duties and import taxes section

- Click Manage

- Select the shipping regions where you’ll be collecting duties and import taxes at checkout

- Review products that have missing information on location to make sure that duties and import taxes are calculated accurately

- Check that your shipping providers and third-party integrations support DDP (Delivered Duty Paid) labels.

- Update your store policy for international sales

- Review your terms and conditions for calculating international taxes and duties at checkout

- Click Agree to get started

How Does This Impact Your Shopify Store?

It will make Tax Day that little bit easier for you. Alongside automatically calculating your tax and duties, it will charge customers extras on international orders – you won’t have to sift through and calculate it. It will be done for you and your customer will see the fees. This is great news for those with a product ready to sell online and looking to use Shopify for it.

Leave a comment